Young Professionals and Student Member Benefits

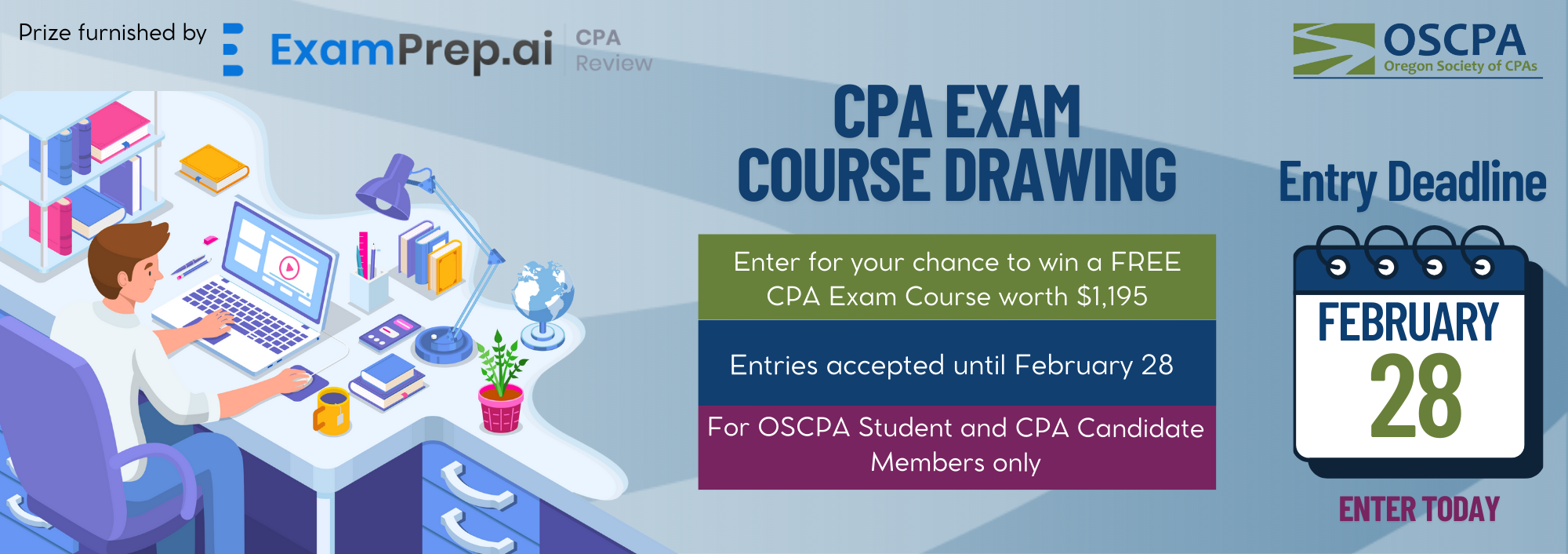

Drawings and Events

Discounts

As an OSCPA student or CPA Candidate member, you have access to many discounts and services designed to help you on your path to becoming a CPA. Click on any of the links below to jump directly to that service in the alphabetical listing.

Becker Professional Education

Save over $500 on Becker's 4-part self-study CPA review courses which include unlimited access, print and digital textbooks, and digital flashcards. Plus, take advantage of our Final Review, 1,900+ additional multiple-choice questions, Live Online and/or Live courses and success coaching, as well as 5 one-hour sessions with a personal tutor.

For more information or to enroll, click here.

Blake Carroll Coaching

OSCPA members receive a 20% discount on exam prep services from Blake Carroll Coaching.

CPA Exam Prep Coaching Videos

Learn the mindset, study techniques, habits and skills needed to tackle the CPA exam in quick daily 3–4-minute videos to view at your own pace

Group coaching

Review study skills, learn together, and keep each other accountable.

FORMAT: Two 1-hour virtual sessions per month and a group message thread

GROUP SIZE: 10-12 people per group to ensure adequate attention and engagements

Blake will speak on a specific topic each session, (goals, study plans, time management, accountability, procrastination, etc.) followed by a Q&A. The group message room will provide daily check-ins and motivation and allow you to ask questions and get feedback from the group quickly.

For more information, click here.

ExamPrep.ai CPA Review

OSCPA members now get 20% off on ExamPrep.ai CPA Review courses!

- Innovative ReadyRating system for exam readiness predictions

- Adaptive quizzes and personalized study plans

- Comprehensive content: 6,700+ questions, 200+ simulations

- Industry-leading pass guarantee included

For more information, click here.

Gleim Exam Prep

OSCPA student and candidate members receive an exclusive 30% discount on Gleim CPA, CMA, CIA & EA Review Systems.

With our innovative SmartAdaptTM technology, exceptional content coverage, and personalized support, you'll have everything you need to study for the CPA Exam or any other professional certification exam more effectively. Gleim has been the leader in accounting exam prep for over 50 years, and in that time, we've helped accountants pass over 1 million exams. With features like the largest test bank on the market, over 100 hours of videos, Access Until You Pass® Guarantee, and the other signature features, the Gleim Review Systems will prepare you better than anything else.

For more information, click here.

MemberDeals

MemberDeals provides OSCPA members with a unique opportunity to access exclusive offers to the world’s greatest entertainment and travel brands, and many other worldwide offers and attractions are available all with special pricing not available to the public.

Save on:

- Travel

- Entertainment

- Shopping

- Pet supplies & pet insurance

- Subscription services

- And much more!

Be sure to visit often as new offers are constantly being added!

For more information, click here.

RuBook Creative™

RuBook Creative™ offers accounting-themed greeting cards, gifts, and children’s books that are made by accountants for accountants. Check out the full collection of accounting-themed items for all accounting occasions including 1) office celebrations like birthdays, graduation, weddings, baby showers, and retirement, 2) motivational cards for CPA Exam takers and team members enduring busy season, 3) holiday cards and other general cards that will make your clients and prospects return your emails. OSCPA members will receive 10% off all orders and 20% off bulk orders of 50 items or more.

For more information, click here.

Surgent CPA Review

OSCPA members receive a 35% discount on Surgent CPA Review!

Pass the CPA Exam with confidence! Surgent CPA Review utilizes an award-winning learning platform, A.S.A.P. Technology™, a proprietary adaptive approach to studying, to help students and professionals better prepare for the CPA Exam while studying less.

Plus, thanks to Surgent’s ReadySCORE™ feature, you will know how you’re performing as you study, as well as have an accurate measurement of what you’d score on the exam if you were to take it that day. Enrollment includes access to 350+ video lectures from engaging instructors, a test bank of more than 7,700 multiple-choice questions, over 400 task-based simulations, customized study guides, and unlimited practice exams. Plus, Surgent’s courses never expire, so students have unlimited access until they pass!

For more information, click here.

Universal CPA Review

Universal CPA Review has teamed up with the Oregon Society of CPAs to offer you 30% off to all of its course packages!

Universal CPA Review is the only CPA review course that is truly designed for visual learners which will allow you to process information faster and retain it longer. Universal CPA Review does not take a traditional, text-heavy approach in delivering its CPA review course materials. Everything from its video lectures to its e-books, to its practice questions come with a unique visual to help CPA candidates better understand the logic behind the information. Universal CPA Review is also the only CPA review course to offer video explanations for every multiple-choice practice question, as if you had a tutor by your side!

For more information, click here.

UWorld Accounting CPA Review

UWorld Accounting CPA Review offers discounts on 4-part CPA Exam Review packages. The 4-part CPA Exam Review program, available for $1,999 for OSCPA members, features unlimited course duration, complimentary advising sessions, personalized study planners, thousands of AICPA aligned questions, and superior answer rationales that explain the what, why, and how of the questions.